Supplier Information and Risk Management

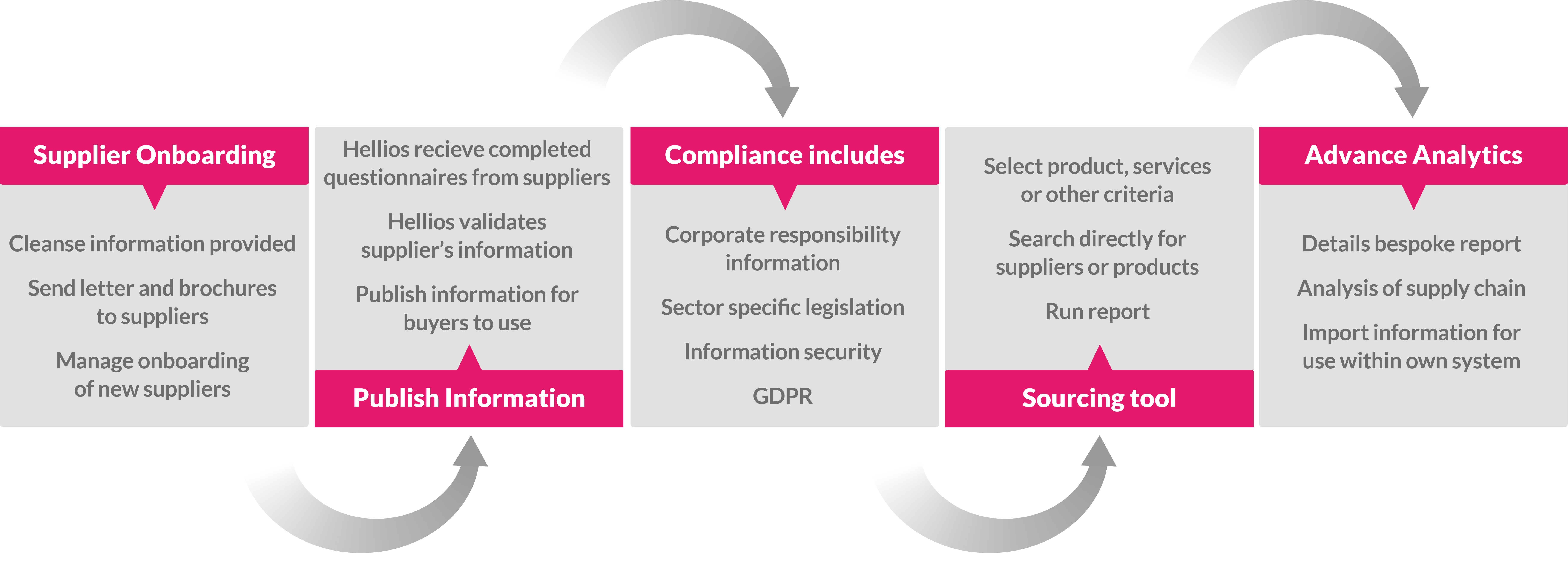

The Process

Initial stage

Second stage

Third stage

Risk & Compliance

FSQS helps financial institutions meet the growing and diverse nature of regulatory requirements when it comes to managing third party risk in the supply chain.

Demonstrating compliance and continual improvement is essential for legal, regulatory and corporate governance standards and as part of effective reputation management.

Managing third party risk and due diligence has become increasingly complex, requiring collaboration across procurement, compliance and risk teams to ensure an efficient and effective approach.

Hellios supplier information and risk management services provide systematic and consistent approaches to managing corporate-wide third party compliance and reporting.

To find out more about how we can support and enhance your third party due diligence, compliance and risk management requirements please contact us today.